Credit scores are very important for anyone considering a real estate transaction such as buying a home or investment property or refinancing a current home. This is because they show how that person has historically handled debt. When mortgage companies or loan officers receive an application for real estate financing, they want to feel confident that the borrower will be able to pay them back. Credit scores can serve as one indicator of the trustworthiness level. The higher the credit score, the higher the confidence there is that the borrower will repay the loan since the borrower has already shown a pattern of debt payoff.

Many mortgage companies require borrowers to have a certain minimum credit score to even be considered for a loan. According to Quicken Loans, “you’ll need a credit score of at least 620 to secure a loan to buy a house.” However, it is still possible to get a loan with a score lower than that. Clients can investigate USDA, FHA, VA and Jumbo loans to see if they qualify for one of these instead of one from a traditional lender. Check out this article to read more about the differences between these types of loans.

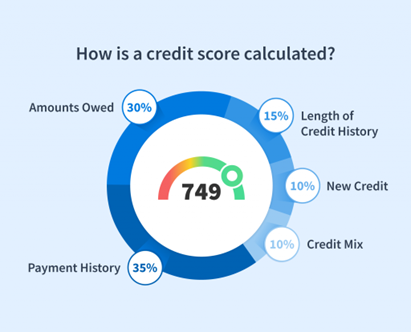

For a conventional loan, many mortgage lenders use FICO® Scores. These scores consider various factors such as payment history, length of credit history, amount still owed, different types of credit, and any recently added credit. Check out this graphic from RentSpree for a standard breakdown:

Typically, a higher FICO® Score will result in a borrower being offered a better mortgage with lower interest rates.

If a buyer is not in a position where their credit score is high, they may still be able to secure a loan. However, the terms and conditions of these loans may not be as favorable. We recommend that a potential buyer consults with a mortgage specialist to determine if they should proceed or take steps to raise their credit score to qualify for more favorable terms.

How can someone improve their credit score? To give a credit score a boost, a person will want to improve the elements that comprise a credit score.

Payment History: An example of how to boost this area is to pay any bills on time, always.

Length: To boost the length of credit history, someone should avoid cancelling or closing any credit cards. Having cards open, even if they are no longer being used, can contribute to a longer length of credit history.

Amount Owed: Simply put, paying down some loan balances can help. If someone is using less of their available credit, it is assumed that they are managing their credit better.

Different Types of Credit: Having different types of credit (credit cards, car loans, etc.) is helpful.

Recently Added Credit: This is a fine balance. While someone will want to have established lines of credit open in order to record consistent pay offs and show good credit, it is important to be cautious about how often new lines of credit are open. Furthermore, someone should also be mindful of not opening a new line of credit too close to the submission of a mortgage loan application.

A credit score is an important part of the house buying, investing, or refinancing process. Lenders look at these scores to determine loan qualification and interest rate and loan terms. We have shared a few tips for strengthening a credit score but encourage anyone looking to improve their credit to contact a mortgage loan officer to review their specific situation and/or a financial advisor for advice and goal setting. Knowing the importance of a credit score’s role in the real estate process is important so that people can make decisions that will improve and support this endeavor. For more information regarding credit scores and their impact on your real estate journey, contact the Oak & Main Real Estate Group.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link